Direct Debit

Docs › Payment Processing › Direct Debit

Last updated: 13 Aug 2020 / 3:17 PM / GMT

In this article, we will take a closer look at Direct Debit as a payment option on our platform.

Direct Debit is a payment option where the customer can make a purchase by transferring funds straight from their bank account, without the need of a credit card.

This can be very useful if a significant part of your customer base are people who are not likely to have credit cards or are simply not in the habit of using them.

Our system uses SEPA Direct Debit via Stripe to process all Direct Debit transactions. This system has two limitations. These are:

- Direct Debit can only be used by customers in countries that belong to the SEPA zone.

- Direct Debit can only be used for transactions in the Euro currency.

This means that the asset price set up in the InPlayer Dashboard will need to be in Euros, and also, the customer’s bank account will have to be Euro-denominated, i.e. support transactions made in Euros.

When using Direct Debit, a very important thing to keep in mind is that due to the nature of this type of banking transaction, the first charge on the customer’s account will not be transferred over immediately like in the case of credit card or PayPal transactions.

Instead, it will take a period of up to 14 business days for the charge to be approved and funds from the customer’s bank account to be transferred over to the merchant. This is the mandate creation period. More on this below.

However, note that the customer will still be granted access at the moment of purchase, just like in the case of credit card or PayPal payments. They will not have to wait for the system to complete the drawing of fund from their account.

This means that the following scenario is possible:

- The customer purchases a pass using Direct Debit.

- The system verifies the bank account.

- The customer is granted access to the content.

- The customer watches the content.

- After 14 business days or less, the system gets a notification from the bank that the customer did not have enough funds for the purchase, or the customer decides to cancel the charge.

- The system revokes access to the content. We are left with a situation where a customer has had access to the content for a time, potentially watched what they wanted to watch, but they have ultimately ended up not paying for it.

For this reason, Direct Debit is more suitable for subscriptions i.e. auto-recurring payments, than it is for Pay-Per-View, i.e. one-time payments that grant access to content for a certain amount of time.

However, our system does not restrict your use of Direct Debit in any way, and you are free to use it for any payment type you wish.

Note also that once a customer approves the mandate on the first charge, all subsequent charges (in cases of a subscription for example) will happen in real-time and without delay.

The payment records for Direct Debit purchases will be created on the date the system has successfully drawn funds from the customer’s bank account. Until then, the records will be shown as pending.

This means that a Direct Debit purchase that was done at the end of the month can potentially be recorded as a purchase in the next month.

You can learn more about payment statuses in this article.

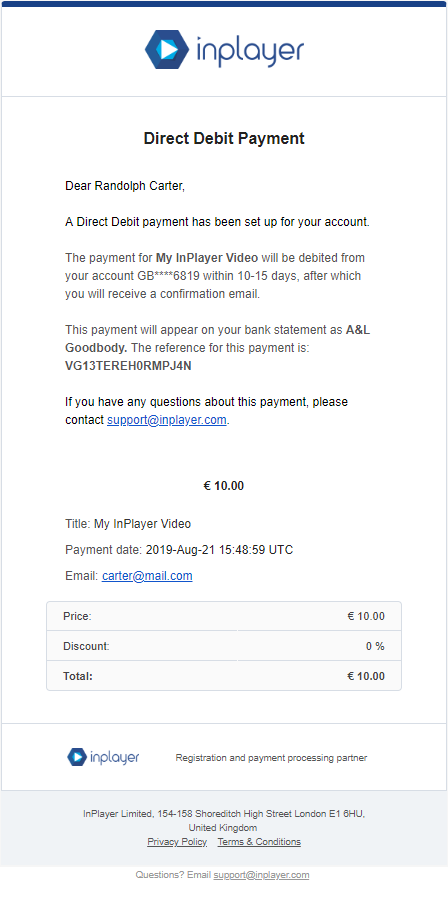

For every direct Debit transaction, the customer will get both a notification email from InPlayer (which can, of course, be white-labelled), and a bank statement from their bank.

The notification email will contain the details of the content the customer has purchased, including the title of the purchased asset.

However, the bank statement will only contain the name of the company to which the payment has been sent.

This company name will always be A&L Goodbody.

A&L Goodbody is a law firm that regulates the SEPA Instant Credit Transfer Scheme.

This too will be clearly stated in the purchase confirmation email the customers will receive so there is no confusion.

If you wish to enable Direct Debit on your InPlayer account, just contact your InPlayer account manager, or send us an email on support@inplayer.com.

As usual, the transaction fees and revenue share for Direct Debit customer transactions are determined by the agreement signed between you and InPlayer.

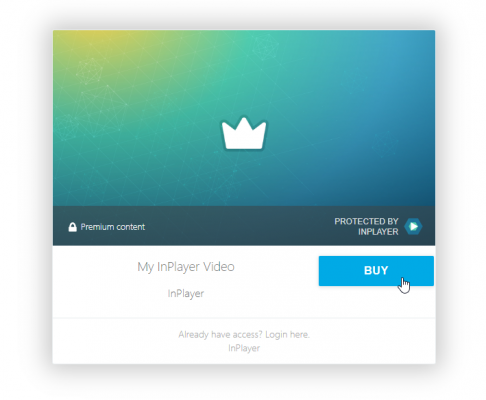

This is the flow of a Direct Debit customer payment:

- Customer clicks the BUY button on an asset on your website.

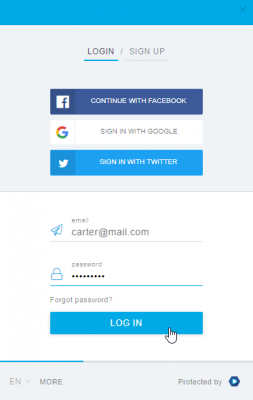

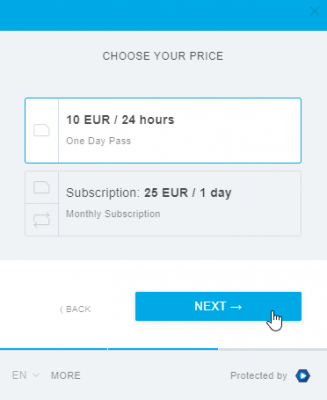

- Customer selects the price option.

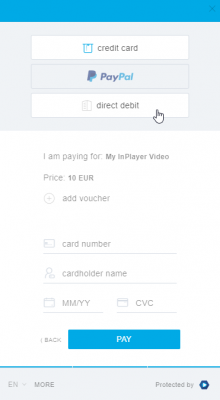

- Customer selects the Direct Debit payment method.

- Customer enters their bank information (Full Name and IBAN number).

With this step, the customer is granting InPlayer permission to draw funds from their account. This is called creating a mandate. No funds are drawn at this stage.

Once a customer successfully creates a mandate once, they will not have to do it again for any future Direct Debit payments made with the same account. Instead, they will be automatically forwarded to the final payment screen. Also, all future payments will be drawn from the customer’s account immediately, without the need for the 14 days waiting period. This period is only for the approval of the mandate during the initial purchase. - The system immediately checks the validity of the customer’s IBAN.

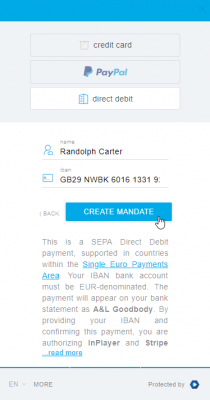

- If the IBAN check is successful:

- Customer can confirm the creation of the mandate.

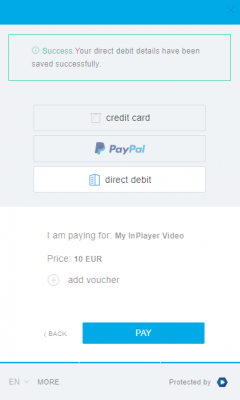

- Customer is presented with the final payment screen, where they can confirm the purchase.

- Customer confirms the purchase.

- The paywall disappears, the customer is granted access to the content, and the content is displayed.

- Customer receives a confirmation email informing them that their purchase was successful, but that the funds are yet to be withdrawn within 14 business days, i.e. as soon as the mandate creation is confirmed.

For subscriptions, the customer will always get a notification email before each recurrent charge, informing them that a Direct Debit transaction will be done on their account in the following days. This is a legal requirement.

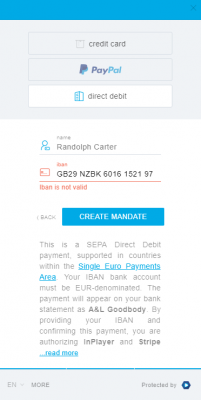

- If the IBAN check is unsuccessful:

- Customer gets an error informing them that the check was unsuccessful. They can try again, or choose another payment method.

- If the IBAN check is successful:

- Provided the customer has completed the purchase successfully, the system has up to 14 business days to confirm the mandate creation and draw the funds from the customer’s bank account.

- If the mandate creation is successful and if the customer’s bank account has enough funds at this time:

- The funds are drawn and the customer keeps their access.

- Customer receives an email informing them that a charge has been done on their bank account.

With this, the transaction is concluded.

- If the mandate creation is unsuccessful and/or if the customer’s bank account doesn’t have enough funds at this time:

- Nothing is drawn and the customer’s access is revoked.

- Customer receives an email informing them that a charge could not be done on their bank account and that their access is revoked as a result. In the case of a subscription, the subscription will be cancelled as well.

- If the mandate creation is successful and if the customer’s bank account has enough funds at this time:

This is the experience a customer will have when making a Direct Debit purchase:

Once they go to your webpage, they click the BUY button on the asset.

They log into their account.

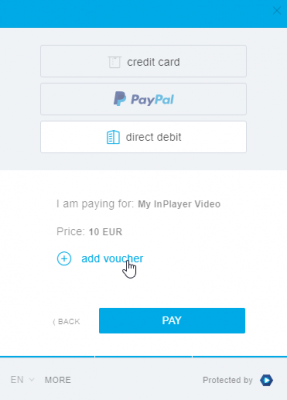

They choose the pass they wish to purchase and click ![]() .

.

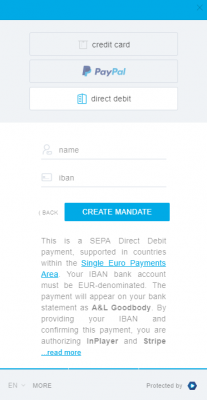

They select Direct Debit as the payment method.

They enter their name and IBAN number.

If the IBAN is not valid, they get an error message:

If the IBAN is valid, they click ![]() .

.

They proceed to the final payment screen where they get a message confirming the successful mandate creation.

If they have a voucher, they will be able to enter it at this point.

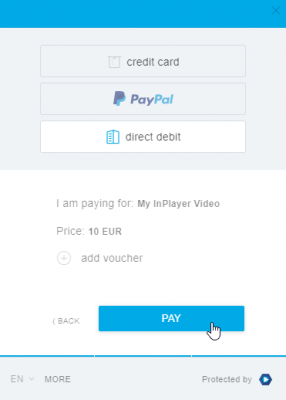

Finally, they complete the purchase by clicking on ![]() .

.

The paywall disappears, and they are presented with the content.

They receive an email informing them that their purchase was successful, but that the funds are yet to be withdrawn within 14 business days.

As soon as our system confirms the drawing of the funds with the bank, the customer will get another email informing them that the charge has been successfully done on their account.

If the drawing of the funds fails, the customer will get an email informing them that the charge has been unsuccessful and that their access has been revoked as a result.

For subscriptions, the customer will always get a notification email before each recurrent charge, informing them that a Direct Debit transaction will be done on their account in the upcoming days.

Lastly, it should be mentioned that once a customer connects (mandates) one bank account, they will not be able to change it. The only way to do this would be for them to register a different account on the paywall.

This concludes our guide.

If you have any questions, don’t hesitate to contact us on support@inplayer.com.