Monetizing premium content requires online strategy which is entirely different than running a traditional business. It is unfamiliar territory that asks for completely different approach.

The widely used quick-fix solution publishers decided to use is the revenue sharing model. However, this model has its own cons we decided to analyzed in this blog post.

Revenue sharing is the distribution of the total amount of income generated by the sale of goods or services between the stakeholders or contributors. It should not be confused with profit shares. As with profit shares only the profit is shared, that is the revenue left over after costs have been removed.

Video content is becoming ever more popular as a content strategy for digital publishers to drive audience engagement and, of course, monetize their efforts.

With using websites like YouTube, Vimeo or DailyMotion content creators basically relinquish a certain level of control of their businesses to these companies. This in turn means that any changes these companies make to their platforms, affect content creators to a large extent.

The belief is if you monetize premium content on this websites you don’t need in-house sales team. Not having an in-house sales team means the publisher relies solely on the mercy of revenue sharing platforms to make any sales and meet targets.

The idea of a partnership begins to fade away when the revenue sharing platform fails to sell enough inventory or doesn’t meet the set targets. Programmatic sales are the only available revenue stream on these platforms.

These platforms offer content producers the opportunity to sell against their own content,

But there is risk involved with using revenue sharing platforms. Often-taxing reporting responsibilities from a platform that permits the publisher to sell inventory.

Another issue that arises is user data. Content producers realize that in addition to their content, their users data is another valuable asset. It is a well known fact that user data drives content, distribution, and hence, monetisation itself, so more structured user data drives more personalized and targeted ads, which lead to higher CPMs and performance.

At InPlayer we allow all user data to remain solely with the publisher — and this can be monetized throughout each user’s life cycle. Easy access for clients’ users to export and/or erase data about them by going to their account page:

When publishers deal with revenue sharing platforms, they (the platforms) focus on the mass requirements making the publisher just one of many others trying to succeed. They don’t create custom experiences for a single publisher, because they are concerned about what the majority of audiences want to see, not a particular target group.

So, how to get the competitive edge in this case? It’s really hard for the content publisher to develop its unique UX not aligned with the RSP’s product strategy.

The more you earn from ads, the more the revenue sharing platform earn as well. In other words, you as a publisher cede control of your revenue to a third party. Revenue sharing models often lock a publisher into utilising a limited set of features that the RSP offers with little ability to influence their roadmap.

Publishers also need to be cautious that RSPs do not have the ability to glean additional insights into their audience through these platforms.

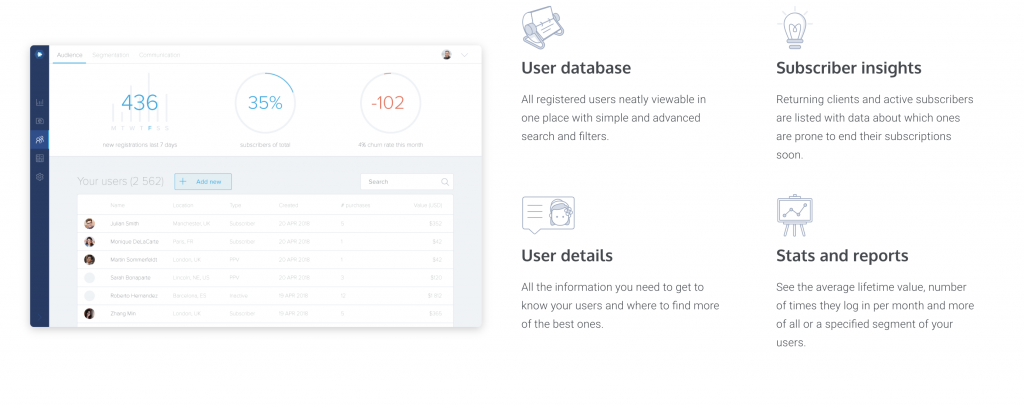

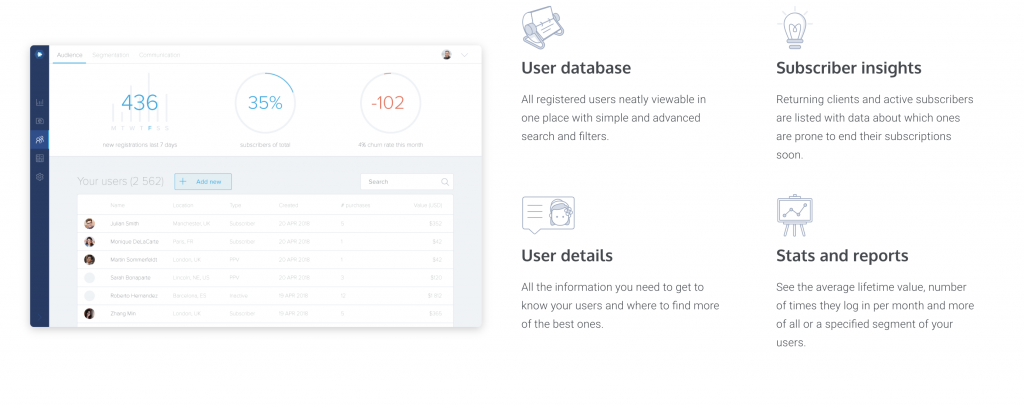

As InPlayer we offer CRM system to manage your own subscribers and one-time customers. Using our paywall you can build your own segments to bring meaningful and comparative insights across your audience. We’ve also created a couple of useful templates with e.g. potential churners and VIP customers.

Also, you can send messages to the right users at the right time. Segments can be set up based on location, activity combined with any parameter we store about your users.

It is a fact that premium video content offers a new revenue stream for online publishers. This means that content producers who are embracing the digital era need to retain complete control of their platforms in order to maximise their revenue potential.

Content is and will be the product that viewers constantly seek. What greater reason than this for publishers to continue investing in it. However, they should present their content in an environment which favours their own brand, and not be at the mercy of corporations that turn a blind eye on local market requirements and opportunities.

Now is not the time for publishers to be confident and not afraid of this exciting new world. Finding partners that help them grow, not partners for the sake of partnership whose brand goals are completely different or competitive with their own.

Sign up to try InPlayer free

Monetizing premium content requires online strategy which is entirely different than running a traditional business. It is unfamiliar territory that asks for completely different approach.

The widely used quick-fix solution publishers decided to use is the revenue sharing model. However, this model has its own cons we decided to analyzed in this blog post.

Revenue sharing is the distribution of the total amount of income generated by the sale of goods or services between the stakeholders or contributors. It should not be confused with profit shares. As with profit shares only the profit is shared, that is the revenue left over after costs have been removed.

Video content is becoming ever more popular as a content strategy for digital publishers to drive audience engagement and, of course, monetize their efforts.

With using websites like YouTube, Vimeo or DailyMotion content creators basically relinquish a certain level of control of their businesses to these companies. This in turn means that any changes these companies make to their platforms, affect content creators to a large extent.

The belief is if you monetize premium content on this websites you don’t need in-house sales team. Not having an in-house sales team means the publisher relies solely on the mercy of revenue sharing platforms to make any sales and meet targets.

The idea of a partnership begins to fade away when the revenue sharing platform fails to sell enough inventory or doesn’t meet the set targets. Programmatic sales are the only available revenue stream on these platforms.

These platforms offer content producers the opportunity to sell against their own content,

But there is risk involved with using revenue sharing platforms. Often-taxing reporting responsibilities from a platform that permits the publisher to sell inventory.

Another issue that arises is user data. Content producers realize that in addition to their content, their users data is another valuable asset. It is a well known fact that user data drives content, distribution, and hence, monetisation itself, so more structured user data drives more personalized and targeted ads, which lead to higher CPMs and performance.

At InPlayer we allow all user data to remain solely with the publisher — and this can be monetized throughout each user’s life cycle. Easy access for clients’ users to export and/or erase data about them by going to their account page:

When publishers deal with revenue sharing platforms, they (the platforms) focus on the mass requirements making the publisher just one of many others trying to succeed. They don’t create custom experiences for a single publisher, because they are concerned about what the majority of audiences want to see, not a particular target group.

So, how to get the competitive edge in this case? It’s really hard for the content publisher to develop its unique UX not aligned with the RSP’s product strategy.

The more you earn from ads, the more the revenue sharing platform earn as well. In other words, you as a publisher cede control of your revenue to a third party. Revenue sharing models often lock a publisher into utilising a limited set of features that the RSP offers with little ability to influence their roadmap.

Publishers also need to be cautious that RSPs do not have the ability to glean additional insights into their audience through these platforms.

As InPlayer we offer CRM system to manage your own subscribers and one-time customers. Using our paywall you can build your own segments to bring meaningful and comparative insights across your audience. We’ve also created a couple of useful templates with e.g. potential churners and VIP customers.

Also, you can send messages to the right users at the right time. Segments can be set up based on location, activity combined with any parameter we store about your users.

It is a fact that premium video content offers a new revenue stream for online publishers. This means that content producers who are embracing the digital era need to retain complete control of their platforms in order to maximise their revenue potential.

Content is and will be the product that viewers constantly seek. What greater reason than this for publishers to continue investing in it. However, they should present their content in an environment which favours their own brand, and not be at the mercy of corporations that turn a blind eye on local market requirements and opportunities.

Now is not the time for publishers to be confident and not afraid of this exciting new world. Finding partners that help them grow, not partners for the sake of partnership whose brand goals are completely different or competitive with their own.

Sign up to try InPlayer free

Super Bowl I, aired live on network television by both CBS and NBC on January 15, 1967, was an inflection point for both sports fandom and sports business. Even if…

Talk around the entertainment industry continues to focus on the crippling effects of COVID-19 on the movie business. Many film sets are quiet, theaters have gone dark and viewers are…

Like so many industries laid low by COVID-19, the movie business has absorbed its share of blows over the past nine months. Public-health mandates closed the doors of most theaters…