Super Bowl I, aired live on network television by both CBS and NBC on January 15, 1967, was an inflection point for both sports fandom and sports business. Even if it didn’t happen all at once, the event marked a revolution in the way we watch and consume sports – a revolution that’s ongoing today.

We still love our sports, but the venue has changed – and, in some corners, the nature of the games themselves, too. Terrestrial television continues to factor into our habits, but much of our sports viewing has begun migrating to streaming platforms. And lately, traditional stick-and-ball sports have had to make room for eSports, which have exploded in popularity with the side-by-side rise of gaming and social media. Could a relationship between the two lift eSports to the next level financially?

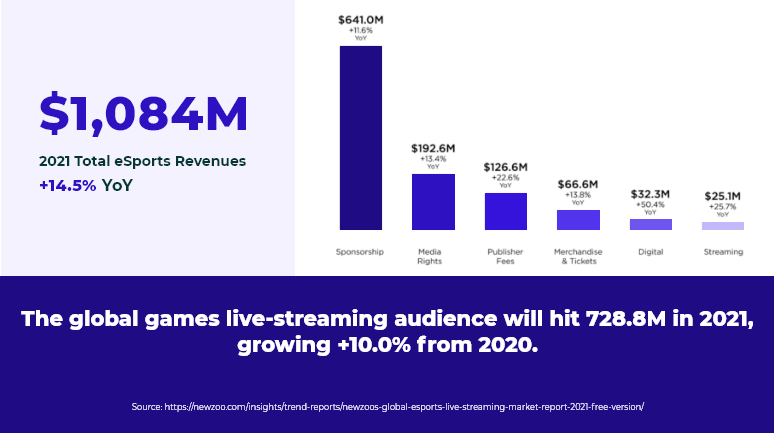

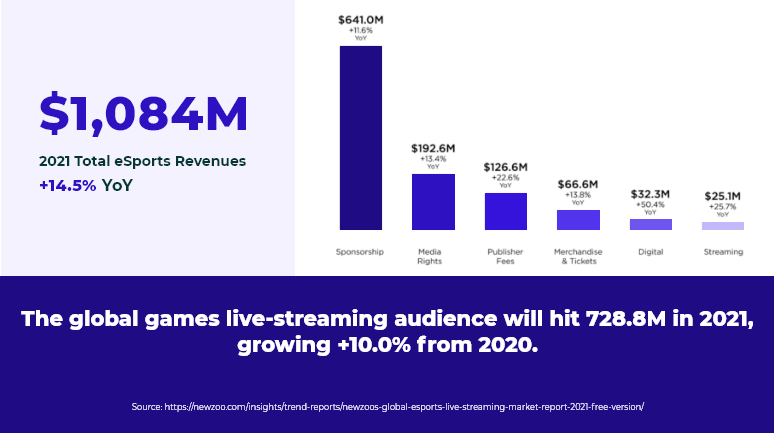

According to market researcher Newzoo, global eSports revenues are expected to reach almost $1.1 billion, with its audience set to grow to 474 million this year. The same analysis projects audience growth of 7.7 CAGR (to 577.2 million) by 2024.

Although the study cited cancellations of in-person events and a resulting dip in merchandise sales as blows to the industry during COVID, Newzoo also predicts a 10 percent increase in the eSports global streaming audience by the end of 2021, as well as continued growth in the years ahead – to a number that, by 2024, is expected to approach 1 billion.

Platforms such as Twitch have been integral to both growing the eSports audience and increasing viewers’ engagement with the product, and the established streaming services will undoubtedly continue to play a central role in eSports’ future. But for those interested in adding new revenue streams or expanding earning potential within the industry in general, a colossal opportunity exists: proprietary OTT channels.

If a league, or even a team, takes advantage of a platform such as InPlayer to develop and curate content on its own streaming channel, that organization has full control over what appears on its broadcasts – not to mention exclusive earning rights. Advertising and sponsorships in the space have high potential to deliver lucrative returns, and the development of content beyond league competitions (think player profiles, making-of documentaries and more) translates not only to a bigger piece of the pie, but also a much bigger pie.

League and team channels open the door to e-commerce integrations, with the potential to swing the recent merchandising downturn in the opposite direction with considerable momentum. Integrations would serve as a built-in marketing arm for merchandise and other related products (imagine the broadcast of a Madden 2022 competition selling the game just a click or two away) as well as a clearer path to purchase for viewers.

Although eSports is already headed down the OTT path, enterprising minds in the industry likely will begin finding new ways to tap into the streaming boom. With eSports’ audience set for significant growth and the industry’s OTT market still wide open for business, now is the perfect time for organizations to start building their own mini media empires.

Super Bowl I, aired live on network television by both CBS and NBC on January 15, 1967, was an inflection point for both sports fandom and sports business. Even if it didn’t happen all at once, the event marked a revolution in the way we watch and consume sports – a revolution that’s ongoing today.

We still love our sports, but the venue has changed – and, in some corners, the nature of the games themselves, too. Terrestrial television continues to factor into our habits, but much of our sports viewing has begun migrating to streaming platforms. And lately, traditional stick-and-ball sports have had to make room for eSports, which have exploded in popularity with the side-by-side rise of gaming and social media. Could a relationship between the two lift eSports to the next level financially?

According to market researcher Newzoo, global eSports revenues are expected to reach almost $1.1 billion, with its audience set to grow to 474 million this year. The same analysis projects audience growth of 7.7 CAGR (to 577.2 million) by 2024.

Although the study cited cancellations of in-person events and a resulting dip in merchandise sales as blows to the industry during COVID, Newzoo also predicts a 10 percent increase in the eSports global streaming audience by the end of 2021, as well as continued growth in the years ahead – to a number that, by 2024, is expected to approach 1 billion.

Platforms such as Twitch have been integral to both growing the eSports audience and increasing viewers’ engagement with the product, and the established streaming services will undoubtedly continue to play a central role in eSports’ future. But for those interested in adding new revenue streams or expanding earning potential within the industry in general, a colossal opportunity exists: proprietary OTT channels.

If a league, or even a team, takes advantage of a platform such as InPlayer to develop and curate content on its own streaming channel, that organization has full control over what appears on its broadcasts – not to mention exclusive earning rights. Advertising and sponsorships in the space have high potential to deliver lucrative returns, and the development of content beyond league competitions (think player profiles, making-of documentaries and more) translates not only to a bigger piece of the pie, but also a much bigger pie.

League and team channels open the door to e-commerce integrations, with the potential to swing the recent merchandising downturn in the opposite direction with considerable momentum. Integrations would serve as a built-in marketing arm for merchandise and other related products (imagine the broadcast of a Madden 2022 competition selling the game just a click or two away) as well as a clearer path to purchase for viewers.

Although eSports is already headed down the OTT path, enterprising minds in the industry likely will begin finding new ways to tap into the streaming boom. With eSports’ audience set for significant growth and the industry’s OTT market still wide open for business, now is the perfect time for organizations to start building their own mini media empires.

Super Bowl I, aired live on network television by both CBS and NBC on January 15, 1967, was an inflection point for both sports fandom and sports business. Even if…

Talk around the entertainment industry continues to focus on the crippling effects of COVID-19 on the movie business. Many film sets are quiet, theaters have gone dark and viewers are…

Like so many industries laid low by COVID-19, the movie business has absorbed its share of blows over the past nine months. Public-health mandates closed the doors of most theaters…